Mastering the PMT Function in Excel: A Comprehensive Guide

The PMT function in Excel is a powerful tool for calculating loan payments, helping users determine the periodic payments required to fully repay a loan, including principal and interest. Whether you’re managing personal finances, analyzing investment opportunities, or evaluating loan options, understanding how to effectively use the PMT function can greatly enhance your financial planning capabilities. In this comprehensive guide, we’ll delve into everything you need to know about using the PMT function, from basic syntax to advanced techniques and real-world applications.

Table of Contents

- Introduction

- Benefits of Using the PMT Function

- Basic Syntax and Usage

- Practical Examples

- Calculating Loan Payments

- Analyzing Mortgage Options

- Evaluating Investment Opportunities

- Advanced Techniques

- Incorporating Additional Parameters

- Handling Variable Interest Rates

- Considering Additional Payment Scenarios

- Handling Errors

- Common Errors and Troubleshooting

- Ensuring Data Integrity

- Tips and Tricks

- Using Named Ranges for Inputs

- Visualizing Loan Amortization

- Comparing Multiple Scenarios

- Real-World Applications

- Personal Finance Management

- Business Financial Analysis

- Investment Planning

- Best Practices

- Validating Results

- Documenting Formulas

- Exploring Alternative Financial Tools

- Conclusion

1. Introduction

The PMT function in Excel is designed to simplify the process of calculating loan payments by providing a straightforward formula for determining the periodic payment amount required to fully repay a loan over a specified period of time. By inputting key parameters such as the loan amount, interest rate, and loan term, users can quickly obtain accurate payment figures, facilitating informed financial decision-making.

2. Benefits of Using the PMT Function

- Accuracy: Calculate loan payments accurately, accounting for principal and interest components.

- Efficiency: Streamline financial calculations and avoid manual computations or complex formulas.

- Flexibility: Customize inputs to analyze various loan scenarios and repayment options.

- Versatility: Use PMT in a wide range of applications, from personal budgeting to investment analysis.

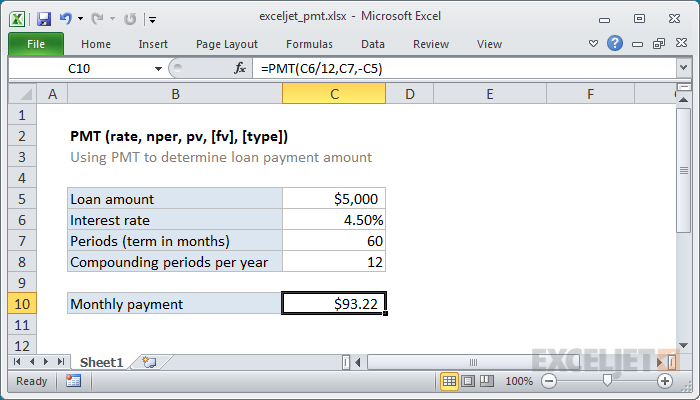

3. Basic Syntax and Usage

The basic syntax of the PMT function is as follows:

=PMT(rate, nper, pv, [fv], [type])

- rate: The interest rate for the loan.

- nper: The total number of payment periods.

- pv: The present value or principal amount of the loan.

- [fv]: Optional. The future value or remaining balance of the loan. Default is 0.

- [type]: Optional. The timing of payments: 0 for end-of-period payments (default) or 1 for beginning-of-period payments.

4. Practical Examples

Calculating Loan Payments

To calculate the monthly payment for a fixed-rate loan:

=PMT(0.05/12, 60, 10000)

This formula calculates the monthly payment for a $10,000 loan with a 5% annual interest rate and a 5-year term.

Analyzing Mortgage Options

To compare mortgage options with different interest rates:

=PMT(B1/12, 30*12, 200000)

This formula calculates the monthly payment for a $200,000 mortgage with a 30-year term, using the annual interest rate listed in cell B1.

Evaluating Investment Opportunities

To determine the required monthly contributions for an investment goal:

=PMT(0.07/12, 10*12, -50000, 100000)

This formula calculates the monthly contribution needed to reach a $100,000 investment goal in 10 years, assuming a 7% annual return.

5. Advanced Techniques

Incorporating Additional Parameters

To account for additional factors such as fees or taxes:

=PMT(0.05/12, 60, 10000, , 1) + 100

This formula adjusts the monthly payment for a $10,000 loan to include a $100 fee, assuming payments are made at the beginning of each period.

Handling Variable Interest Rates

To analyze loans with variable interest rates:

=PMT(IF(A2="Fixed", 0.05/12, 0.04/12), 60, 10000)

This formula calculates the monthly payment for a $10,000 loan with a 5% interest rate if the loan type is “Fixed,” and a 4% interest rate if the loan type is “Variable.”

Considering Additional Payment Scenarios

To evaluate the impact of additional payments on loan repayment:

=PMT(0.05/12, 60, 10000) + 50

This formula adjusts the monthly payment for a $10,000 loan to include an additional $50 payment each month, accelerating the loan repayment schedule.

6. Handling Errors

Common Errors and Troubleshooting

- #VALUE! Error: This error occurs if any of the input arguments are not valid numbers or if the rate argument is less than or equal to 0.

- #NUM! Error: This error occurs if the specified number of payment periods is not a valid number or if any of the input arguments result in an invalid calculation.

Ensuring Data Integrity

Double-check input values and formula parameters to ensure that all inputs are valid and accurately represent the loan or investment scenario.

7. Tips and Tricks

Using Named Ranges for Inputs

Define named ranges for loan parameters to simplify formula inputs and updates:

- Select the cells containing loan parameters.

- Go to the Formulas tab > Define Name (in the Defined Names group).

- Enter a name for the range and click OK.

Visualizing Loan Amortization

Create a loan amortization table to visualize the breakdown of principal and interest payments over time, using the PMT function in conjunction with other financial functions like PPMT and IPMT.

Comparing Multiple Scenarios

Use scenario analysis to compare different loan options or investment strategies by adjusting input parameters and observing the resulting changes in monthly payments or investment returns.

8. Real-World Applications

Personal Finance Management

Use the PMT function to budget for major purchases, such as cars or homes, by estimating monthly loan payments and evaluating affordability.

Business Financial Analysis

Incorporate loan payment calculations into financial models to assess the impact of debt financing on business operations and cash flow.

Investment Planning

Analyze investment opportunities by determining the required periodic contributions needed to achieve financial goals, such as retirement savings or education funds.

9. Best Practices

Validating Results

Verify PMT calculations against alternative loan calculators or financial software to ensure accuracy and reliability in real-world scenarios.

Documenting Formulas

Document PMT formulas with comments or annotations to explain their purpose and inputs for future reference and audit trails.

10. Conclusion

The PMT function in Excel is an invaluable tool for financial planning, offering a straightforward method for calculating loan payments and analyzing various financial scenarios. By mastering the basic syntax, exploring advanced techniques, and applying best practices, users can leverage the PMT function to make informed decisions about loans, investments, and personal finances. Whether you’re managing debt, evaluating mortgage options, or planning for retirement, the PMT function empowers you to navigate complex financial landscapes with confidence and precision. With its accuracy, efficiency, and versatility, the PMT function is an essential component of any Excel toolkit, helping users unlock insights and achieve their financial goals effectively. Start harnessing the power of the PMT function today to take control of your financial future.

Now, armed with this comprehensive guide, you’re ready to tackle any financial analysis or decision-making task using the PMT function in Excel. Whether you’re a seasoned finance professional or a novice Excel user, the PMT function offers a simple yet powerful solution for calculating loan payments and making informed financial decisions. So go ahead, explore the possibilities, and take your financial analysis to new heights with the PMT function in Excel!